Investing in property has the potential to provide astute buyers with an excellent return. But, as any seasoned investor will tell you, you need to spend money in order to make money. It needn’t cost you thousands of dollars, however, to add value to your home and increase your equity. There are a few key things you can do even on a shoestring budget.

It’s the little things

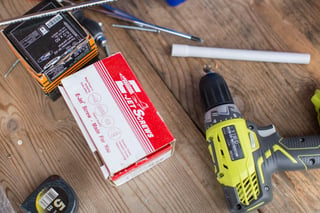

Sometimes the simplest things have the most impact: replacing door handles, kitchen cupboard handles and light fixtures is a cost-effective means of modernising your home and adding value.

With a little more budget, updating windows and doors not only improves the aesthetics of your home, it can help lower your heating and cooling bills, and even increase the amount of natural light inside your home.

It’s surprising the difference a fresh coat of paint can make in a home. It easily revives and brightens a tired space. If your budget is limited, try painting a feature wall to add depth to a room.

Changing the flooring by simply adding a rug to hardwood floors or tiles can reduce noise, improve insulation and add a modern touch to your home.

Tired kitchens or bathrooms can easily be updated by changing a portion of the room rather than undergoing a full renovation. Simply updating the flooring, retiling the walls, fitting new appliances or changing out the countertops can change the entire look of a room, adding significant value for a surprisingly low spend.

Declutter and deep clean

Clearing away the clutter in your home can have a dramatic impact. Not only does it leave you with a perception of more space, a much fresher and tidier appearance, decluttering has surprising health benefits according to experts – both mentally and physically. Decluttering could even make you a little money!

Try walking around your home and viewing each room through the eyes of a stranger, identifying those items that are simply taking up valuable space. Then, tackle one room at a time, separating your necessities from the things you really don’t need.

Here’s a good rule of thumb to use when decluttering:

- Put away any items that have crept out of their storage space like coffee cups or piles of laundry.

- Recycle any paper, plastic or glass.

- Fix any broken items or throw away anything beyond repair.

- Find a charity or someone in need and donate those items you no longer need.

A deep clean of your home both inside and out, tackling all of those tasks you usually avoid, can have an immediate return on the value of your property.

Avoid over-improving

While it may be your goal to grow your wealth by investing in property, it’s worthwhile remembering not to overspend on renovations where you won’t see a return on your investment.

Before you consider any type of renovation, do your research on the area you’re in to determine how much your property may be worth after renovations. That will give you a good idea of how much you realistically should spend.

If you are thinking about adding value to your home, either through some small changes or with a major renovation, get in touch with a Mortgage Express broker to talk about your options for refinancing.

References:

https://www.thebalance.com/increase-the-value-of-your-property-2124841

https://mortgagesupply.co.nz/designer-home-on-a-shoestring-budget/?

Disclaimer:

While all care has been taken in the preparation of this publication, no warranty is given as to the accuracy of the information and no responsibility is taken by Finservice Pty Ltd (Mortgage Express) for any errors or omissions. This publication does not constitute personalised financial advice. It may not be relevant to individual circumstances. Nothing in this publication is, or should be taken as, an offer, invitation, or recommendation to buy, sell, or retain any investment in or make any deposit with any person. You should seek professional advice before taking any action in relation to the matters dealt within this publication. A Disclosure Statement is available on request and free of charge.

Finservice Pty Ltd (Mortgage Express) is authorised as a corporate credit representative (Corporate Credit Representative Number 397386) to engage in credit activities on behalf of BLSSA Pty Ltd (Australian Credit Licence number 391237) ACN 123 600 000 | Full member of MFAA | Member of Credit Ombudsman Services Ltd (COSL) | Member of Choice Aggregation Services.