From electricity bills to phone plans, car insurance through to home loans, sticking with the same provider year after year could mean you’re paying “lazy tax”. Lazy tax is the penalty many consumers and homeowners are paying as a result of being complacent, not shopping around for the best interest rates, and failing to refinance when rates work in their favour. If this sounds like you, here are two ways to avoid paying lazy tax.

1. Don’t set and forget

Research findings from online data platform, True Savings shows Australians are paying a staggering $3.6 billion in “lazy taxes” each year. A significant proportion of that figure is attributed to homeowners who are being charged a mortgage loyalty tax, largely as a result of a “set and forget” mindset when it comes to their home loan.

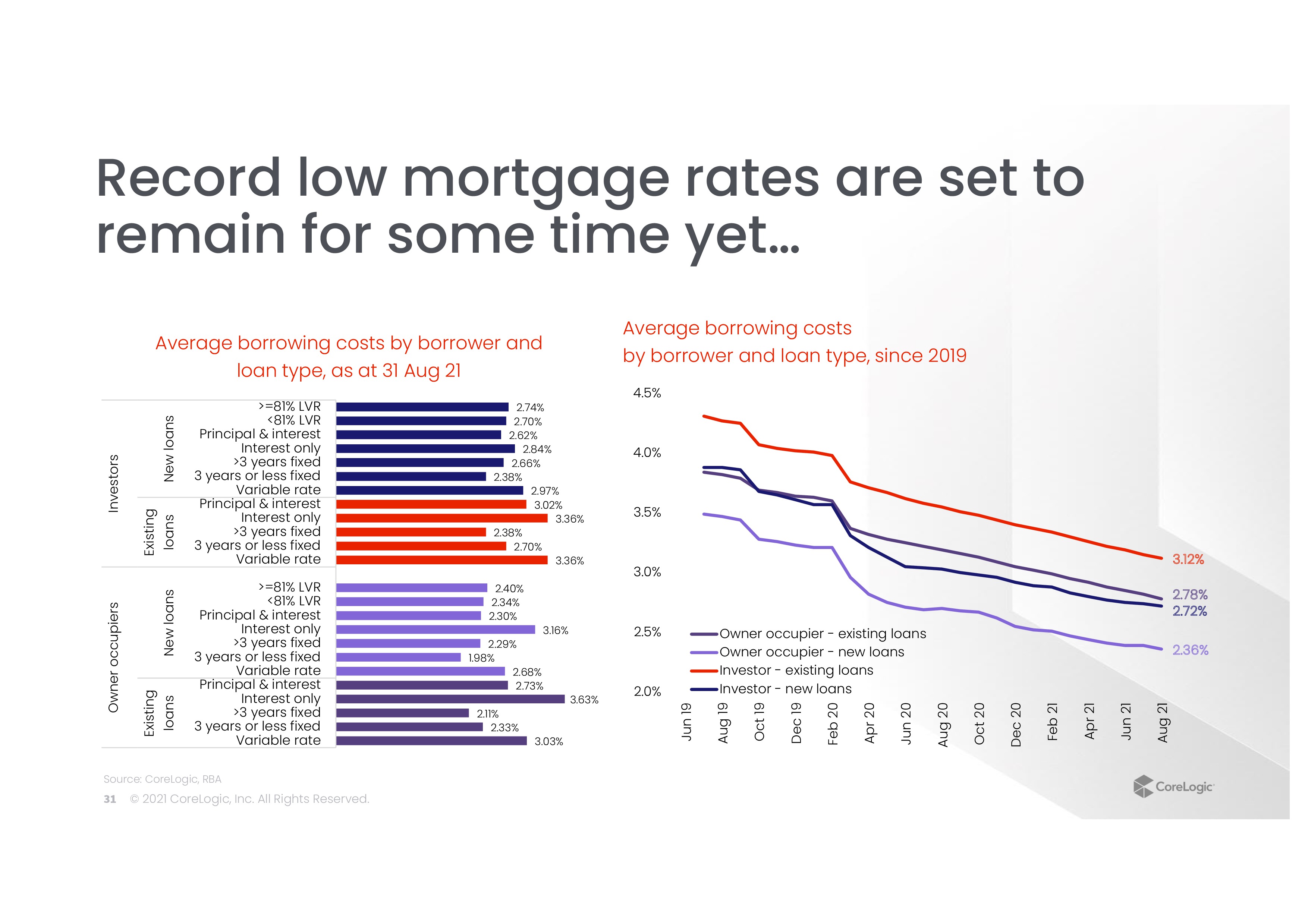

Homeowners who start out on a reasonable interest rate gradually end up paying more than new customers do, as the rate gap between interest rates offered to new customers versus existing customers gradually widens over time. Many of these homeowners are missing out on significant savings simply by failing to refinance.

Today finance expert, Effie Zahos captured it perfectly here: "The cheapest deals that are out there now is 1.77 per cent," she said.

"The thing to take away is what interest are you paying, are you paying more than that, ask your lender to match it and don't pay the lazy tax."

2. Review your home loan regularly

Homeowners who haven’t reviewed their home loan interest rates in some time – even just a year – could be paying rates than is necessary. A simple way to check if you’re paying more than you should, is to compare how your interest rate stacks up against rates advertised by lenders for new customers. If you find a lower interest rate, it’s possible you’re paying a lazy tax – or mortgage loyalty tax – to your lender.

Borrowers who may be paying a lazy tax can either negotiate a lower rate with their existing lender or refinance with a new lender. In either case, it’s worthwhile researching your options before deciding which is right for you – refinance or renegotiate. Talk to a mortgage broker, as there’s usually more to consider than simply interest rates.

But even the smallest decrease in interest rates can add up to significant savings over time. So it’s worthwhile reviewing your interest rates every 12 months to ensure you’re always getting the best rate available to you.

Don’t get caught out paying a lazy tax

While interest rates remain at record lows, that’s not to say all Australians are getting the best deal on their home loan. Not shopping around and comparing interest rates could mean you miss out on interest rate deals that are being offered by lenders to new customers.

Ask yourself:

What is the interest rate you’re paying now?

Are you paying more than this?

If you are, ask your mortgage broker to get you on to that deal!

Contact Mortgage Express to find out more.

While all care has been taken in the preparation of this publication, no warranty is given as to the accuracy of the information and no responsibility is taken by Finservice Pty Ltd (Mortgage Express) for any errors or omissions. This publication does not constitute personalised financial advice. It may not be relevant to individual circumstances. Nothing in this publication is, or should be taken as, an offer, invitation, or recommendation to buy, sell, or retain any investment in or make any deposit with any person. You should seek professional advice before taking any action in relation to the matters dealt within this publication. A Disclosure Statement is available on request and free of charge.

Finservice Pty Ltd (Mortgage Express) is authorised as a corporate credit representative (Corporate Credit Representative Number 397386) to engage in credit activities on behalf of BLSSA Pty Ltd (Australian Credit Licence number 391237) ACN 123 600 000 | Full member of MFAA | Member of Australian Financial Complaints Authority (AFCA) | Member of Choice Aggregation Services.