As the end of the financial year (EOFY) approaches, it's important to take proactive steps to ensure you're making the most of available tax benefits. Whether you're an individual taxpayer, business owner, or investor, EOFY is when we wrap up the current financial year, complete bookkeeping tasks, lodge tax returns, and prepare for the new financial year. Set yourself up for financial success with these essential tax tips for end of financial year.

Review Your Finances

- Take a comprehensive look at your financial situation, including your income, expenses, and investments.

- Consider any capital gains or losses from investments, as these can impact your tax liability.

- Contact a finance consultant to get help assessing your overall financial health so you can make informed decisions.

Claim All Deductions and Concessions

- Familiarise yourself with the various tax deductions and concessions available to you, such as work-related expenses, home office costs, educational expenses, charitable donations, and personal superannuation contributions.

- For small business owners, an instant tax deduction may be available for depreciating assets costing less than $20,000 and acquired between 1 July 2023 and 30 June 2024.

- Keep thorough records of your expenses and ensure you meet the eligibility criteria for claiming deductions.

Stay Informed About Tax Changes

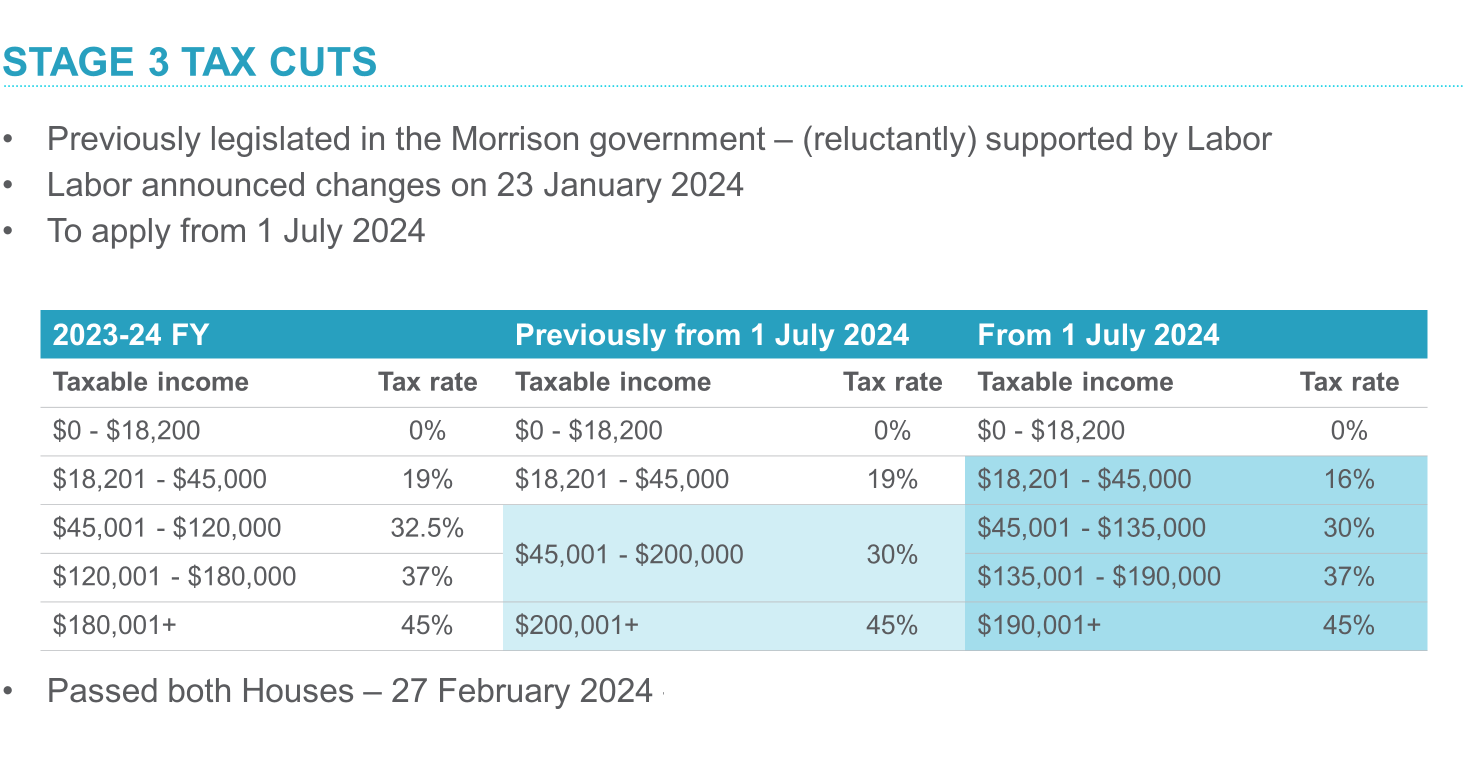

- Keep up to date with any changes to tax laws or regulations that may impact your tax obligations.

- Monitor government announcements and updates from the Australian Taxation Office (ATO) to ensure compliance with current requirements.

Engage a Registered Tax Agent

- Get advice from a tax agent registered with the Tax Practitioners Board to help you navigate the complexities of tax filing.

- A qualified tax agent can guide you through the process, answer your questions and ensure you maximise your tax deductions and offsets.

Review Your Business Structure

- If you're a business owner, assess your current business structure to ensure it still aligns with your financial goals and objectives.

- Consider the tax implications and asset protection benefits of different business structures, such as sole trader, company, partnership, or trust.

- Consult with a business adviser or your accountant to determine the most suitable structure for your business needs and future growth plans.

Beware of Tax Refund Scams

- Be cautious of any unsolicited emails, phone calls, or text messages claiming to offer large tax refunds.

- Scammers often target individuals during tax season, posing as government agencies or tax authorities to steal personal information or money.

- Verify the legitimacy of any communications by contacting the relevant tax authority directly or consulting with a trusted finance consultant.

Evaluate Your Business and Marketing Plans

- Take this opportunity to review your business goals, objectives, and marketing strategies, and develop a strategic plan for the upcoming year.

- Analyse your performance over the past financial year and identify areas for improvement or expansion.

Check Your Insurances

- Review your insurance policies, including business, health, and personal insurance coverage.

- Consult with an insurance broker or finance consultant to ensure that you have adequate protection against potential risks and liabilities.

Important Dates

- June 30 is EOFY in Australia, so plan ahead to meet any filing deadlines or reporting requirements.

- Use digital tools or calendar reminders to stay on top of important dates and avoid any last-minute rush or penalties for non-compliance.

EOFY is an important time for businesses and individuals alike. By taking proactive steps now, you'll be well-prepared for the new financial year. Get financial advice from a Mortgage Express finance consultant or seek expert tax advice from a registered tax agent who can tailor recommendations to your specific situation and help you make informed decisions.

While all care has been taken in the preparation of this publication, no warranty is given as to the accuracy of the information and no responsibility is taken by Finservice Pty Ltd (Mortgage Express) for any errors or omissions. This publication does not constitute personalised financial advice. It may not be relevant to individual circumstances. Nothing in this publication is, or should be taken as, an offer, invitation, or recommendation to buy, sell, or retain any investment in or make any deposit with any person. You should seek professional advice before taking any action in relation to the matters dealt within this publication. A Disclosure Statement is available on request and free of charge.

Finservice Pty Ltd (Mortgage Express) is authorised as a corporate credit representative (Corporate Credit Representative Number 397386) to engage in credit activities on behalf of BLSSA Pty Ltd (Australian Credit Licence number 391237) ACN 123 600 000 | Full member of MFAA | Member of Australian Financial Complaints Authority (AFCA) | Member of Choice Aggregation Services.