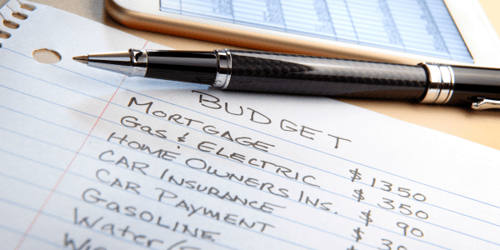

Whether you’re buying a first home, upsizing or downsizing, or growing a property portfolio, setting a budget is an essential first step to working out how much you can afford and how much you may be able to borrow. From setting SMART goals to dodging “lazy tax” and sticking to the 50/25/25 rule, these three essential budgeting tips for Australian home buyers will help you make savvy financial decisions and turn home ownership dreams into reality.

1. Set SMART Goals

Before you begin your home buying journey, set SMART goals – goals that are Specific, Measurable, Achievable, Relevant, and Time-bound. Setting SMART goals will help you stay focused and motivated throughout the process, while guiding your budgeting decisions.

Think of your SMART goals as instructions for making your home ownership dreams come true, so make the time to map out your plan of action.

- Specific: Be specific and detailed about what you want in a home.

- Measurable: Calculate how much it will cost and how much deposit you’ll need.

- Achievable: Determine your financing options and decide if you need to save for longer.

- Realistic: Check that your expectations match your budget.

- Time: Decide when you’ll be ready to buy a home.

2. Don't Pay Lazy Tax

From electricity bills and internet plans to car insurance and home loans, sticking with the same provider for years could mean you’re paying "lazy tax." Lazy tax is when you overpay for services because you haven’t shopped around or negotiated a better deal. As prices creep up over time, you may not notice you’re getting penalised in this way.

Costs that are worth shopping around for include power, mobile plans, broad, car and contents insurance, car loans, personal loans and even home loans. By regularly reviewing utility bills, insurance policies and subscription services, negotiating to get better deals, refinancing when interest rates work in your favour, and switching providers to save money, you can avoid becoming a victim of lazy tax!

3. Follow the 50/25/25 Rule

Achieving financial balance is essential to successful budgeting and this useful guideline can help you manage your finances while ensuring you put away enough money each month. Following the 50/25/25 rule can help you stick to a budget, save for the future, and still enjoy the things you love.

The 50/25/25 rule suggests you allocate 50 per cent of your income to essentials like mortgage or rent, utilities and groceries; 25 per cent towards long-term finance goals such as saving for a deposit or paying off debt; and 25 per cent for general day-to-day spending, things like entertainment, holidays, or shopping.

Well-equipped for home ownership

Navigating home ownership can be challenging, especially when it comes to managing finances. By following a budget and these three essential tips, you’ll be well-equipped to face whatever home buying challenges come your way.

Another essential for navigating the home buying process in Australia is working with an experienced mortgage broker. Mortgage Express mortgage brokers understand the local property market and the challenges facing home buyers today. By providing expert guidance and realistic financing solutions, our team of mortgage brokers help first home buyers, existing homeowners and property investors buy the homes of their dreams.

While all care has been taken in the preparation of this publication, no warranty is given as to the accuracy of the information and no responsibility is taken by Finservice Pty Ltd (Mortgage Express) for any errors or omissions. This publication does not constitute personalised financial advice. It may not be relevant to individual circumstances. Nothing in this publication is, or should be taken as, an offer, invitation, or recommendation to buy, sell, or retain any investment in or make any deposit with any person. You should seek professional advice before taking any action in relation to the matters dealt within this publication. A Disclosure Statement is available on request and free of charge.

Finservice Pty Ltd (Mortgage Express) is authorised as a corporate credit representative (Corporate Credit Representative Number 397386) to engage in credit activities on behalf of BLSSA Pty Ltd (Australian Credit Licence number 391237) ACN 123 600 000 | Full member of MFAA | Member of Australian Financial Complaints Authority (AFCA) | Member of Choice Aggregation Services.