Introduced in July 2021, the Family Home Guarantee aims to help eligible single parents to purchase their own home, already, close to 2,500 of the 10,000 places made available under the program, with around 85 per cent of those going to single mothers. Here’s more on the Family Home Guarantee.

What is the Family Home Guarantee?

The Family Home Guarantee is an Australian Government initiative announced in the 2021/22 Federal Budget in response to the COVID-19 pandemic. The aim of the program is to support single, eligible parents, with at least one dependent and a deposit of at least 2 per cent, to buy their own home.

From 01 July 2021, 10,000 places will be made available to single parents under the Family Home Guarantee, regardless of whether the borrower has already owned a property or is a first home buyer. Borrowers must intend to live in the property being purchased, as investment properties are not supported under the program.

How does the Family Home Guarantee work?

The Family Home Guarantee program is administered by the National Housing Finance and Investment Corporation (NHFIC) on behalf of the Australian Government. Eligible single parents with dependents can apply for a loan to purchase an eligible property through a participating lender.

The NHFIC will guarantee up to 18 per cent of the value of the property to the participating lender, provided the borrower has a minimum 2 per cent deposit and is eligible for the program, enabling single parents with at least one dependent to enter, or re-enter, the property market sooner.

Who is eligible?

To be eligible for the Family Home Guarantee, borrowers need to meet these basic eligibility criteria:

- Australian citizens who are at least 18 years of age.

- Must be a single parent with at least one dependent.

- A taxable income that does not exceed $125,000 per annum for the previous financial year. NB: Child support payments are not included as income for the purpose of the income cap.

- The single parent must be the only name listed on the loan and the certificate of title.

- It is expected that the single parent will show that they are legally responsible (whether alone or jointly with another person) for the day-to-day care, welfare and development of the dependent child and the dependent child is in their care. Depending on the terms of any shared custody arrangement, this may enable both individuals in a former couple to separately access the Family Home Guarantee.

- Individuals must have at least 2 per cent of the value of the property available as a deposit. If the borrower has a deposit of more than 20 per cent, then the home loan cannot be covered by the Family Home Guarantee.

- Loans under the Family Home Guarantee require scheduled repayments of the principal and interest of the loan for the full period of the agreement. The loan agreement must have a term of no more than 30 years.

- Applicants must intend to be owner-occupiers of the purchased property.

What types of property can be purchased?

For a property to be eligible under the Family Home Guarantee, it must be a residential property including:

- an existing house, townhouse or apartment

- a house and land package

- land and separate contract to build a home

- an off-the-plan apartment or townhouse

What are the property price thresholds under the scheme?

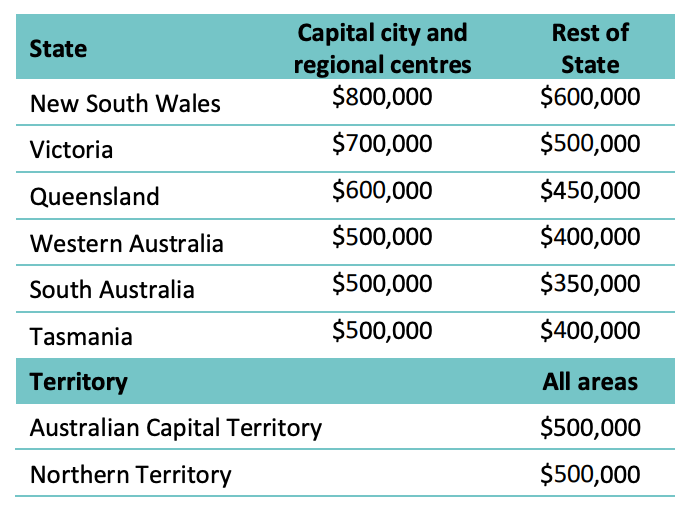

House price caps for the Family Home Guarantee are the same as those that apply to the First Home Loan Deposit Scheme.

How do I apply?

Borrowers who meet the above eligibility criteria can apply for the Family Home Guarantee through a FHLDS participating lender. If you have questions about the program or would like to find out more about getting a mortgage as a single parent, contact a Mortgage Express broker today.

While all care has been taken in the preparation of this publication, no warranty is given as to the accuracy of the information and no responsibility is taken by Finservice Pty Ltd (Mortgage Express) for any errors or omissions. This publication does not constitute personalised financial advice. It may not be relevant to individual circumstances. Nothing in this publication is, or should be taken as, an offer, invitation, or recommendation to buy, sell, or retain any investment in or make any deposit with any person. You should seek professional advice before taking any action in relation to the matters dealt within this publication. A Disclosure Statement is available on request and free of charge.

Finservice Pty Ltd (Mortgage Express) is authorised as a corporate credit representative (Corporate Credit Representative Number 397386) to engage in credit activities on behalf of BLSSA Pty Ltd (Australian Credit Licence number 391237) ACN 123 600 000 | Full member of MFAA | Member of Australian Financial Complaints Authority (AFCA) | Member of Choice Aggregation Services.