Home ownership for Australians has long been considered a key milestone in life, and it plays an important role when it comes to boosting retirement income too. Homeowners considering downsizing to a smaller home in their retirement years, could give their Super a last-minute boost by adding up to $300,000 tax-free from the sale of a property. Find out more about Downsizer Contributions, the eligibility criteria, and how pension entitlements could be impacted.

What are Downsizer Contributions?

Downsizer Contribution allows older Aussies to sell their main residence and contribute some of the proceeds into their super account.

From 1 January 2023, homeowners aged 55 years or older may be eligible to make a Downsizer Contribution of up to $300,000 to a complying super fund from the proceeds of the sale of their home provided it has been owned for 10 years or more. Prior to 1 January 2023, you had to be 60 years or older to make a Downsizer Contribution.

A Downsizer Contribution doesn’t count towards any of the contribution caps – and can still be made even if a person has total super savings greater than $1.7 million, or if they do not meet the work test requirements. It is a one-time-only concession and doesn’t apply to the sale of any residences in the future.

Provided your spouse is aged 55 years or older from 1 January 2023, they can also make a Downsizer Contribution to their own super of up to $300,000 from the same proceeds, even if they are not an owner of the property. But the couple contributions cannot be more than the total sale price of the property.

What are the benefits?

Contribution caps don’t apply:

Regardless of how much you already have in your super, the total super savings test doesn’t apply for Downsizer Contributions.

Tax efficient:

The downsizer contribution is an after-tax contribution, so no tax is paid on the way in.

You don’t have to buy a new property:

The money you make from the sale doesn’t have to be used to buy a new home, and there is no need to move to something smaller or cheaper.

What are the eligibility criteria?

The key criteria for qualifying for Downsizer Contributions are:

- You must be aged 55 or older. There is no upper age limit on Downsizer Contributions and no work test requirement either.

- You must have owned the property for a continuous period of at least 10 years. This is usually measured from the date of your original settlement when you purchased the property, to the settlement date when you sell it.

- The property being sold must be your family home (main residence) at the time of the sale, or it must be partially exempt from capital gains tax (CGT) under the main residence exemption.

- The home you sell must be in Australia.

- Some types of property are not eligible under the downsizer rules including investment property that is not the main residence, caravans, houseboats and other mobile homes. Vacant blocks of land are also ineligible.

How do Downsizer Contributions impact pension entitlements?

Making a Downsizer Contribution can reduce or even eliminate your entitlement to an Age Pension or DVA service pension, so it’s important to weigh up the benefits against the potential impact on your retirement income before going ahead with this option.

As your main residence, your home is exempt from the Age Pension assets test and remains exempt for up to 24 months after the sale of the property (with effect from 1 January 2023). However, once the exemption period is over, the remaining proceeds from the sale of your home are counted under the Age Pension income test - deemed to be earning 0.25 per cent, the current lower deeming rate - which could mean your entitlement to government benefits and support – such as the Age Pension – are cut or reduced.

Case study example

Fred and Francis are aged 68 and 66 respectively.

They have owned their family home for 12 years, however for the first 3 years of their ownership, it was rented.

They list their home for sale in May 2022 and enter a contract to sell the home for $900,000 in July 2022.

They are planning to buy an apartment for $500,000. The surplus arising from the sale of their main residence is $400,000.

They could each make a Downsizer Contribution of $200,000, or any other combination, up to the maximum of $300,000 per person.

If Fred and Francis are receiving an age pension, the surplus proceeds from the sale of their main residence ($400,000) will be treated as an assessable asset and will result in their age pension reducing or ceasing to be payable, depending on their overall financial position.

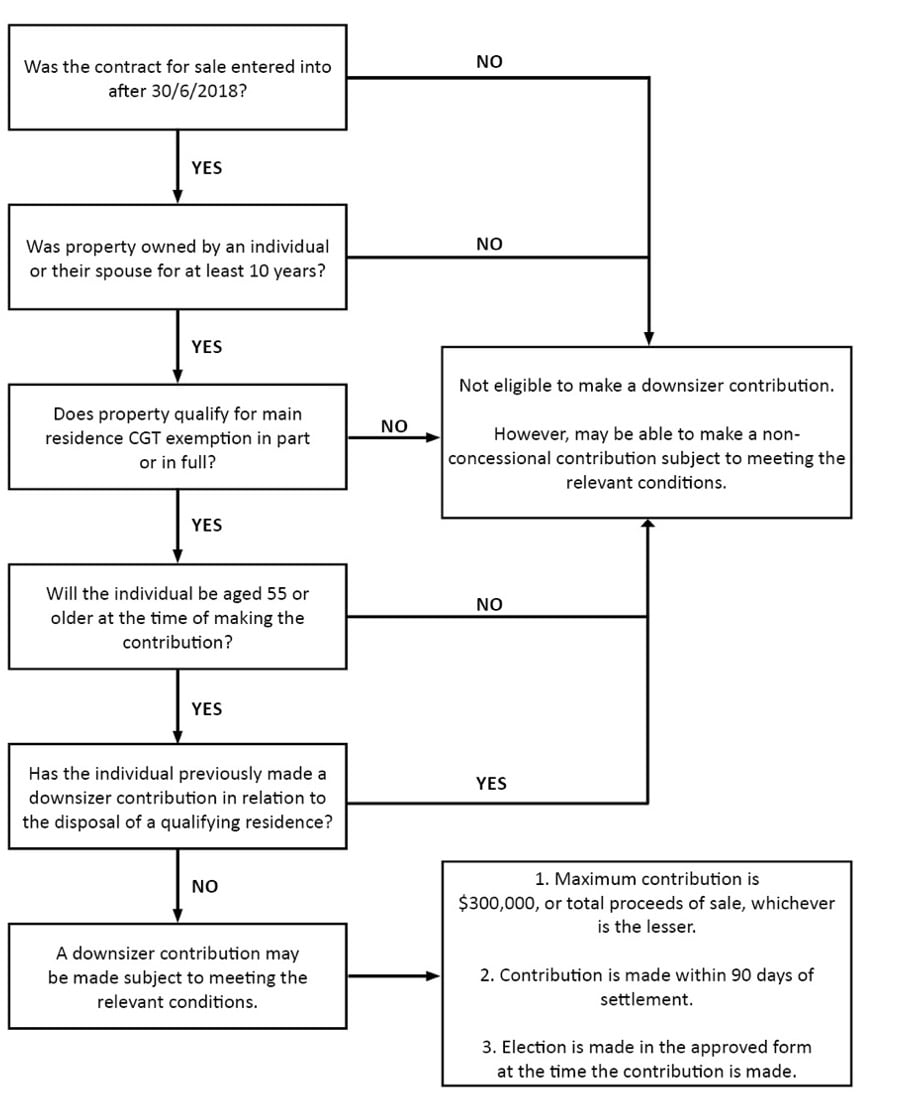

Use the following flow chart to assess your eligibility to make a Downsizer Contribution.

“The information contained in this document does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions. Whilst all care has been taken in the preparation of this document (using sources believed to be reliable and accurate), to the maximum extent permitted by law, no person including Centrepoint Alliance Limited or any member of the Centrepoint Alliance Group of companies accepts responsibility for any loss suffered by any person arising from reliance on this information.”

Is Downsizer Contribution right for you?

Before you sell your home, carefully consider the pros and cons and the potential impact that Downsizer Contributions could have on any government entitlements. If you are considering making a Downsizer Contribution, get professional financial advice so you can make an informed decision about your retirement income.

While all care has been taken in the preparation of this publication, no warranty is given as to the accuracy of the information and no responsibility is taken by Finservice Pty Ltd (Mortgage Express) for any errors or omissions. This publication does not constitute personalised financial advice. It may not be relevant to individual circumstances. Nothing in this publication is, or should be taken as, an offer, invitation, or recommendation to buy, sell, or retain any investment in or make any deposit with any person. You should seek professional advice before taking any action in relation to the matters dealt within this publication. A Disclosure Statement is available on request and free of charge.

Finservice Pty Ltd (Mortgage Express) is authorised as a corporate credit representative (Corporate Credit Representative Number 397386) to engage in credit activities on behalf of BLSSA Pty Ltd (Australian Credit Licence number 391237) ACN 123 600 000 | Full member of MFAA | Member of Australian Financial Complaints Authority (AFCA) | Member of Choice Aggregation Services.